Invest in Botero art and build a legacy that transcends generations.

- The price of Botero artwork has gone up 13% per year over the last seven years.

- Art is a stable asset that increases the value of your portfolio and significantly decreases its volatility.

- Botero is considered one of the most important modern artists of the 20th & 21st century.

WHY INVEST IN ART

The value of blue chip art outpaced the S&P 500 by 43% between 1995 and 2024.

*Masterworks

*Christies & Sothebys public auction data

The average value of Botero’s artwork sold at public auction has increased 13% per year over the last seven years.

Six Reasons to Invest in Botero Art

LEGACY ART FUND

Art is a mainstream stable alternative asset.

Deloitte’s Art Investment Report confirms that over 50% of family offices include art in their investment portfolios.

1

LEGACY ART FUND

Botero art shows consistent and significant price growth.

Over sixty Botero works of art have been sold for over $1 Million at Chrsities & Sothebys public auctions with “Los Musicos” reaching a record $5.1 Million in Nov 2024.

2

LEGACY ART FUND

Art price performance is uncorrelated with shares & bonds.

Investing in art increases the return and reduces the volatility of a well balanced investment portfolio.

3

LEGACY ART FUND

The volume of Botero art sold at public auction is up.

The total number of Botero artwork sold at public auction doubled since 2018 to 71 pieces in 2024.

4

LEGACY ART FUND

Legacy Art Fund Bonds – ease of investment.

The Legacy Art Fund bonds are fully backed by Botero artwork. The fund’s ISIN code simplifies it inclusion in any investment portfolio.

5

LEGACY ART FUND

Be part of Botero’s exciting art world.

Legacy Art Fund keeps you up to date with Botero art exhibitions, news and in depth information.

6

"Art should be an oasis, against the hardness of life. "

Fernando Botero

BOTERO ART

Some outstanding works of art

The Musicians (1979)

217 x 189 cm

Private sales 2005: $1,250,000

Sothebys Public Auction 2024: $5,132,000

Price Increase: 310% (15 años)

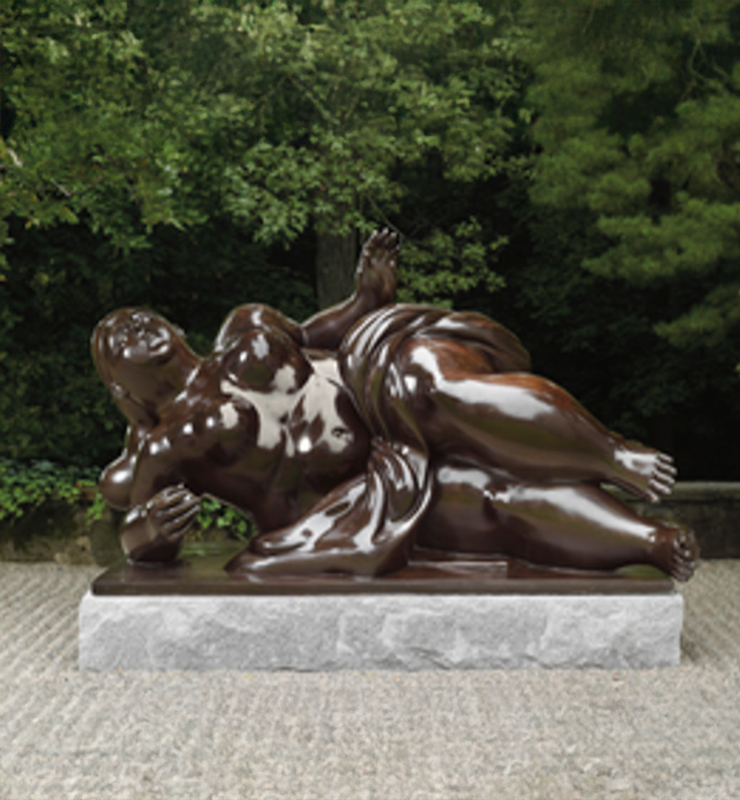

Venus (1989)

152 x 230x 117cm

Private Sale: 2004: $ 401,000

Christies sale 2008: $ 962,000

Price Increase: 240 % (4 años)

Circus (2008)

70 x 101 cm

Private sale 2018: $ 393,000

Private sale 2022: $ 850,000

Price Increase: 220% (4 años)

Still Life with Watermelon (2008)

194x148 cm

Private Sale : 2018: $650,000

Private sale 2024: $1,000,000

Price Increase: 53% (6 años)

Contrabass (1999)

186x 117 cm

Private Sale 2018: $680,000

Private sale 2019: $870,000

Price Increase: 27% (1 año)

Horse

Private Sale : $540,000

Sothebys Public Auction 2024: $4,920,000

Price Increase: 910% (22 años)

The Legacy Art Team

Botero Art Knowledge & Expertise

Fernando Botero Zea, son of the artist, is the main consultant and investor of the Legacy Art fund. Fernando and his team have close ties with leading galleries, art dealers and collectors that specialize in Botero. The Legacy Art Fund’s promotional capacity and international network is second to none.

Art Fund Management Expertise

Brian Chiswell & Gerardo Zurbrugg, directors of the Legacy Art fund, bring over ten years of art fund management experience having successfully launched and managed The Collectors Choice Art Fund listed in the Vienna Stock Exchange.

Art Investment Process

Step 1

Investment IN:

text

Step 2

Art Selection Process:

The Legacy Art Fund’s art committee has extensive knowledge and access to Botero artwork on a worldwide basis providing the fund with an unparalleled variety of options. The committee will analyze over twenty works of art before making a single choice. Every work of art is re-confirmed for provenance and authenticity.

Step 3

Artwork Purchased:

Investment in the fund is diversified between a variety of different Botero paintings,sculpture and drawings of all sizes. The total value of the fund is based on the value of the artwork and is divided pro-rata amongst its investors.

Step 4

Art Exhibitions:

The fund’s artwork is actively and strategically promoted through art exhibitions and art fairs including Art Basel, MACO, ARCO, FRIEZE amongst others. The fund’s art collection is also shown through galleries and at selected five-star hotels worldwide.

Step 5

International Sales

The art sales team at Legacy Art fund headed up by Juan Camilo Montana has a network of important collectors worldwide from NY to Hong Kong, Mex City, Zurich and Manila. This diversity of artwork and high end collectors means the sale of Botero artwork is dynamic at well valued prices.

Step 6

Investment OUT

The Legacy Art Fund is priced on a quarterly basis and offers liquidity twice a year in March and September.

The value of Botero artwork has doubled in value in just seven years.

*Masterworks public auction data

THE LEGACY ART FUND

Terms and Conditions:

| Total Issue Size | $50,000,000 |

| Minimum Investment | $50,000 |

| Legacy Art Fund Objective Return | 8% per year |

| Liquidity | Every 180 days |

| Fund & Art Valuation | Every 90 days |

| ISIN Code | CH12345678 |

| Bond Issuer | AAFS Luxembourg |

| Bond Pricing | Bloomberg |

| Bonds Clearing | SIX SIS AG / Clearstream / Euroclear |

| Legacy Art Bond Regulators | Luxembourg Central Bank / CSSF |

| Paying Agent | 2.5% |

| Bond Price Listing | Telekurs. Bloomberg |

| Type of Artwork | Painings, Sculpture, Drawings |

| Portfolio Manager | TCC Artchain GmbH |

Disclosure: The information on this web site is for marketing purposes only and does not offer any guarantee on returns, performance or outcome of The Legacy Art Fund. The United States citizens and residents are prohibited from investing directly or indirectly in the Fund. The Fund has not been registered under the United States securities act of 1933. The purchase of the fund involves a degree of risk and should be considered only by persons who can bear the risk. Please contact a representative of the Fund for further information.

Press, Events and Exhibitions

How to invest

Contact us at for further information and one of our consultants will get in contact.